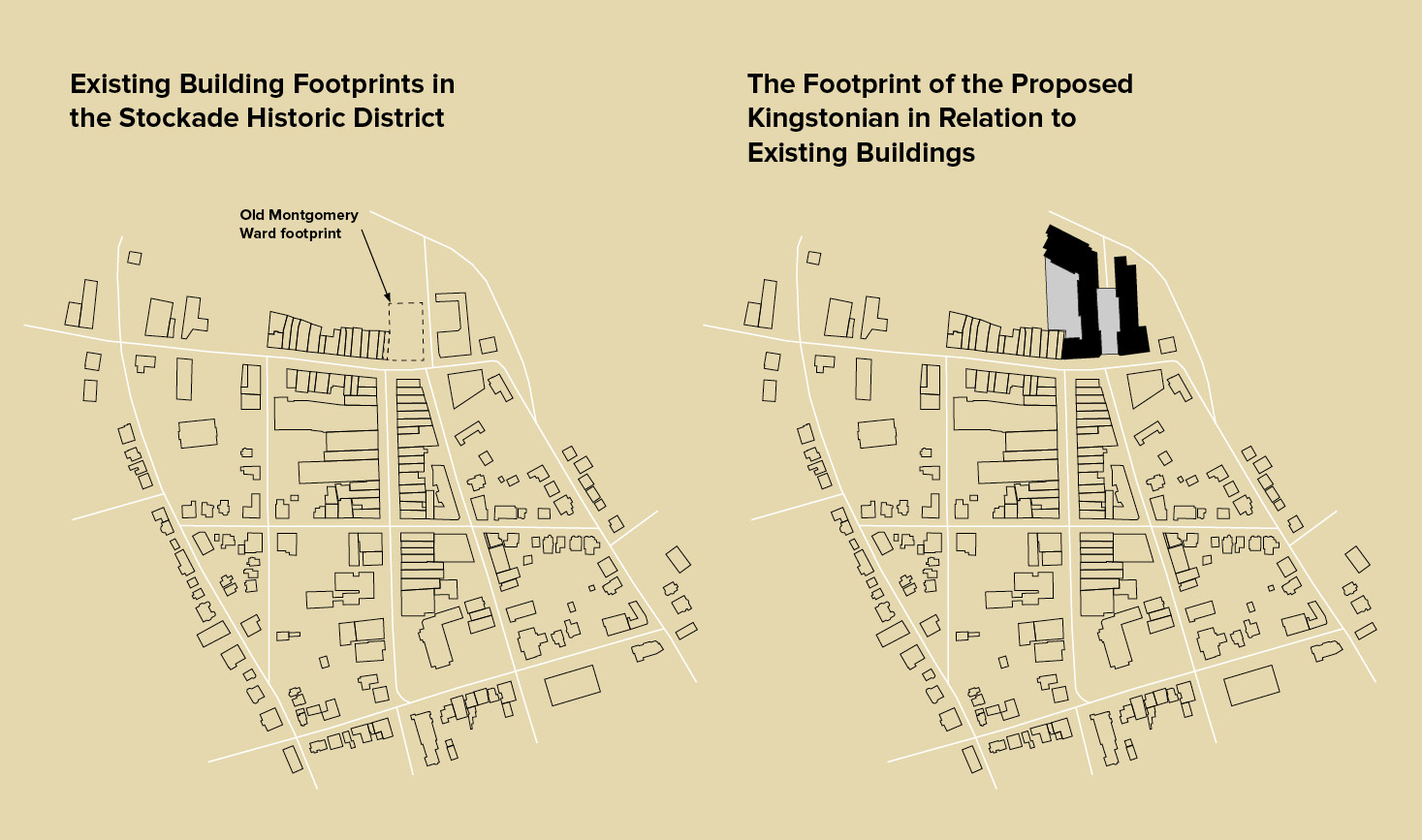

The above image comparison courtesy of Marissa Marvelli’s illustrated guide for understanding architectural appropriateness in the Stockade Historic District

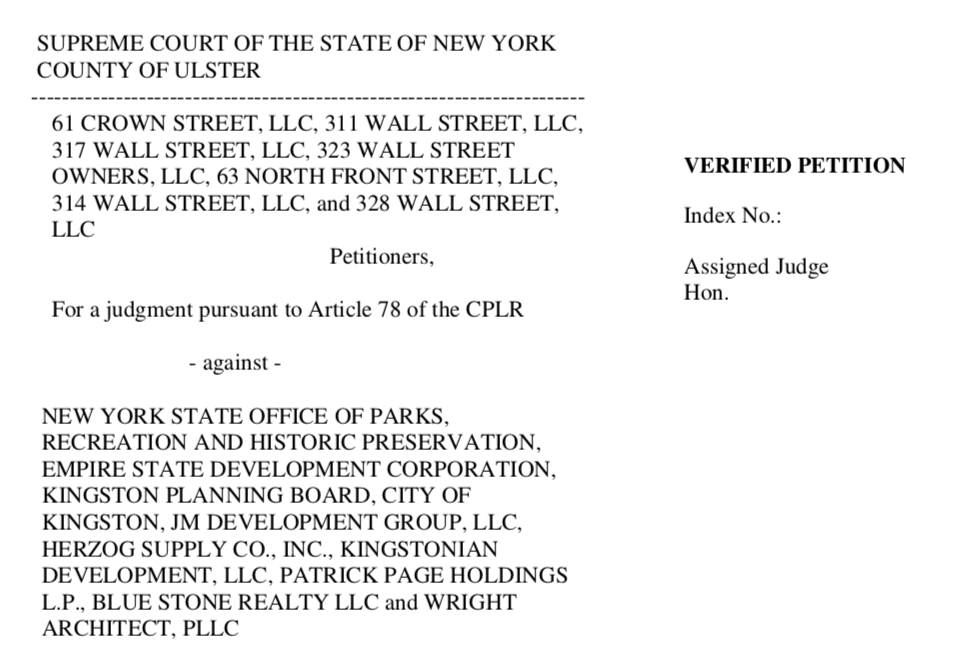

On Friday August 21, another Article 78 and a Verified Complaint was filed by a consortium of Uptown business entities against the City of Kingston, Kingstonian Developers and state agencies.

The Article 78 suit filed against the City of Kingston, the Kingstonian developers, the New York State Office of Parks, Recreation & Historic Preservation (OPRHP) and Empire State Development Corporation was to annul OPRHP’s February 14, 2020 decision (see below) determining that the proposed mixed use development (incorporating a 420 car garage, 143 apartments, 32 room boutique hotel, and 9,000 square foot retail/restaurant space, pedestrian plaza and walking bridge) located at the intersection of Fair Street and North Front Street, within the National Register-listed Kingston Stockade Historic District (KSHD), along with the rezoning of approximately 0.313-acres of property to accommodate the same, would not have any adverse impacts on the Kingston Stockade Historic District.

As we reported back in February, “…without any significant changes proposed by the developers, the New York State Historic Preservation Office (SHPO) chose to unsee the adverse impacts that it had identified in September 2019 in the course of its review of the Kingstonian. The only rational explanation for this unexpected and illogical about-face is that this is the result of political pressure exerted by the Empire State Development Corporation (ESDC) and by extension, Governor Andrew Cuomo.

According to a February 14 letter to the ESDC from John Bonafide, Director of the Technical Division Bureau at SHPO, “After considering the material presented at our meeting and the subsequently submitted information, we have found that the evolution of the proposal has addressed many of the open preservation issues raised by this office.” However, the only change that has been made since his office last reviewed the project in September is that the Schwenk Drive portion of the development grew another story. Impacts that were identified in the agency’s September 19 letter, such as the project’s size, its monolithic scale, and its eradication of Fair Street Extension, have not been mitigated in the least.

SHPO’s comments on the Kingstonian are part of a consultation mandated by Section 14.09 of the New York Parks, Recreation and Historic Preservation Law. It is required for projects that are funded, licensed or approved by state or federal agencies. The Kingstonian is set to receive $3 million in funding from the ESDC. The majority of the project site lies within the National Register-listed Stockade Historic District.”

READ: “The State Preservation Office does about-face for Kingstonian project amid political pressure”

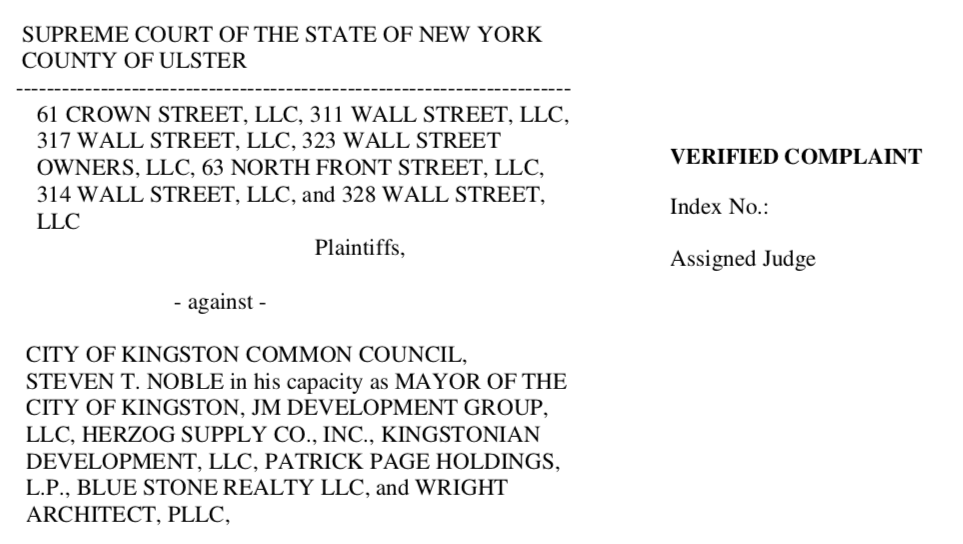

At the same time, a verified complaint against the Kingston Common Council, Mayor of Kingston and the developers was also filed, declaring that a portion of the proposed Kingstonian project property owned by the City of Kingston is parkland and subject to the public trust doctrine. According to the complaint, it was illegal for city to sell or alienate the park without prior authorization from the State in the form of legislation enacted by the New York State Legislature and approved by the Governor of New York State and completion of SEQRA on the alienation.

The complaint also states that the Mayor’s execution of two different Memorandum of Understanding’s (MOU) dated 1/10/17 and 6/19/17 should be null and void as neither were done with the consent of the Kingston Common Council.

In the June MOU, Wright Architects oddly assigned all of its right, title and interests to JM Development Group for what appears to be a $50,000 sum.

READ the January 10 and June 19 of 2017 Memorandum of Understandings.