Editorial Board

This week, the Kingston Common Council unanimously approved general terms for a $30.6 million dollar deviated payment in lieu of taxes (PILOT) for the Kingstonian project. Although the Kingston Common Council may believe that the tax-free deal for luxury apartments is a good deal for Kingston, it is only one of the three involved agencies that will need to approve the PILOT before it can be implemented by the Ulster County Industrial Development Corporation (UCIDA). The agencies include the Ulster County Legislature (UCL) and the Board of Education (BOE) for the Kingston City School District (KCSD). We anticipate the two remaining agencies will hold public discussions and a vote sometime in September and October. Write and call your representatives and ask when the PILOT is scheduled to be on their agenda and to explain in advance (and in writing) the impacts of a tax-free deal for luxury housing will have on your school taxes.

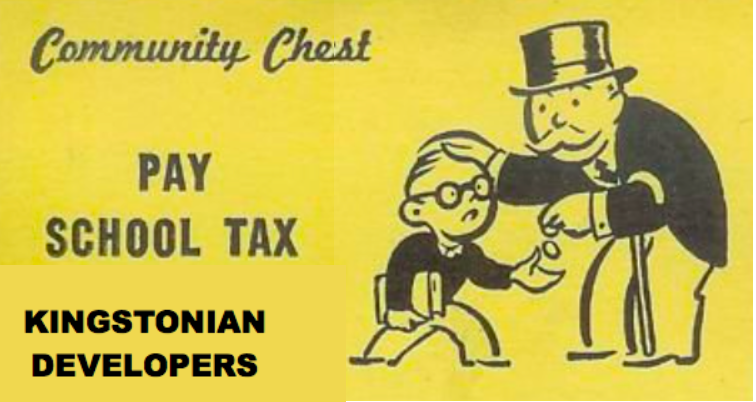

A wealthy developer will pay no school tax for 25 years?

What didn’t get a whole lot of traction during the Kingston council debate was the fact that the Kingstonian developer will pay nearly no school tax to the KCSD, and that impact will be felt by every municipality that pays into the school tax base.

In their PILOT application, the developers say that they anticipate minimal impact on the Kingston City School District because a similar project of theirs’ in Poughkeepsie has produced no school-aged residents. To further woo decision-makers, the developers are offering a $5,000 per year (for ten years) scholarship fund through the Community Foundation for the KCSD to use at their discretion. This translates into $50,000 over the course of 10 years in exchange for no school taxes for 25 years. Another pittance in comparison to their school tax without a PILOT is a $40,000 payment that will be apportioned to the city, county and school district. If 60% of the total tax burden – or approximately $24,000 a year – would be paid to the school district, all it would take is 1 1/2 new students to wipe that out.

What will it cost us?

So far, the developers characterize their financial information as “trade secrets” and have aggressively sought to shield that financial information from the public. Without this important information, the public does not know what portion of the $57,885,000 project is taxable and therefore, has no ability to calculate cost or potential benefits to taxpayers over 25 years.

Though at a recent special Kingston Common Council Finance and Audit Committee meeting, City of Kingston Assessor Dan Baker said that if the Kingstonian project were built today, the full property assessed value would be $19,000,000. Based on the 2019-2020 non-homestead tax rate, the school tax calculation of $30.10 per $1000, the school tax bill alone would be approximately $571,900 per year. Assuming the assessed value fluctuates and increases based on inflation and cost of living from year to year, the uncollected school taxes could end up being a staggering $18 million dollars over the life of the 25 year PILOT.

A tax-free deal for luxury apartments in Kingston will be felt beyond the Kingston city boundary. PILOTs result in less taxable value which requires everyone else to make up the difference. Municipalities that pay Kingston City School taxes include the Towns of Esopus, Hurley, Marbletown, New Paltz, Kingston, Rosendale, Saugerties, Ulster and Woodstock.

Take action

CLICK ON THIS LINK to send a letter to the Ulster County Legislators that represent those living in the impacted communities and the Board of Education to insist that the Kingston Project developers pay their fair share of school taxes. You can also call your representatives at the numbers below.

The developers will be counting on the Ulster County Legislature and Board of Education in September and October to approve their PILOT terms. Will our representatives allow the developer to defer taxes for the school district because the applicant claims that there will not be school aged children living in the Kingstonian property? By this logic, anyone without children in the public school system should not be required to pay school taxes.

Education is a public good for which we all have a responsibility to pay taxes because we all benefit from an educated populace. Tell your Ulster County Legislature the BOE to reject the Kingstonian tax-free deal and insist that they pay their fair share of taxes for their luxury apartment and boutique hotel development.

(Image above courtesy of Hasbro Monopoly)

Ulster County Legislature with constituents in the Kingston City School District

Mary Wawro (District 1) includes Town of Saugerties

(845) 246-1017

Al Bruno (District 2) includes Town of Saugerties

(845) 340-3900 (Legislature offices)

Dean Fabriano (District 3) includes Town of Saugerties and Town of Ulster (845) 246-2067 or (845) 389-5201

Brian Cahill (District 4) Town of Ulster and Town of Kingston

(845) 340-3900 (Legislature offices)

Abe Uchitelle (District 5) City of Kingston

(845) 340-3900 (Legislature offices)

Dave Donaldson (District 6) City of Kingston

(845) 399-8709 or (845) 331-8985

Peter Criswell (District 7) City of Kingston

(845) 340-3900 (Legislature offices)

Laura Petit (District 8) Town of Esopus

(845) 340-1293

James Delaune (District 17) Town of Esopus

(914) 475-4342

Heidi Haynes (District 18) Town of Hurley and Marbletown

(845) 224-1806

Manna Jo Greene (District 19) Town of Rosendale and Marbletown

(845) 687-9253

Johnathan Hepner (District 23) Town of Woodstock and Hurley

(845) 594-3141

Kingston City School District: Board of Education

James Shaugnessy, President

845-339-5262

Steven Spicer, Vice President

845-340-1103

Cathy Collins

Herb Lamb

845-334-8844

Priscila Lowe

845-331-2298

Robin Jacobowitz

917-566-6957

Suzanne Jordan

845-339-0002

James Michael

845-389-4746

Nora Scherer

845-339-3909

Because the cost of Education is a constant amount, Unfair Pilots simply transfer the tax burden from the developer to all the other taxpayers, who’s taxes will increase as a result of the unfair Pilots. All elected officials should be leery of passing developer savings onto their constituents as tax increases. CHARLES LANDI

If I build a broom ? closet at my house my taxable assessment goes up and I pay an increase share of the tax burden.

The developers have bamboozled the public and elected leaders!

Just because the developers claim that this project will result in additional sales tax doesn’t mean they shouldn’t have to pay their fair share of school taxes — otherwise, every single commercial property shouldn’t have to pay their fair either because most commercial properties generate sales tax from the good and services they sell?

Just because the developers claim no school aged children will live at the Kingstonain they shouldn’t have to pay their fair share of school taxes? Well, If that’s true then every property owner with no school aged kids should have to pay either…

It’s a joke.

At the end of the day the developers will likely pay less than 1% of total revenues in property taxes while enjoying 99% of the benefits

Meanwhile, the public will have the enjoyment of paying 8.5% sales tax, $1.50 per hour to park along with the increased costs of school, city and County taxes!

Somehow this developement benefits all residents?

This is absolutely wrong. Why should these millionaires get any tax breaks? Why is the city ok with taking from our children? These common council members needs to get their heads out of their wallets and in public interests. The rich help the rich and everyone else is pays the price.

I urge all of you to look into the future. This project is a true throw back to an outdated era. The terrible iorny here the common council are supporting a painfully outdated ideas like parking projects and gated communities by destroying the historical integrity of this city. Why would those interested in the future of Kingston seek to not pay their share of school taxes. It’s an absurd contradiction. Just like this project. Please do some research and reconsider. This a not progress, this is selling our future so there can be short term profits for the very few.

Look at the test scores and graduation rates for the KCSD and tell us that these funds are not needed for the students of the district.

It not fair to place all to burden of school taxes on the local home owners. Some of these property developers or not from here, but they will make more housing units for more people and families to live here. They should be made to take on this towns expenses.