Editorial Board

This week, the Kingston Common Council unanimously approved general terms for a $30.6 million dollar deviated payment in lieu of taxes (PILOT) for the Kingstonian project. Although the Kingston Common Council may believe that the tax-free deal for luxury apartments is a good deal for Kingston, it is only one of the three involved agencies that will need to approve the PILOT before it can be implemented by the Ulster County Industrial Development Corporation (UCIDA). The agencies include the Ulster County Legislature (UCL) and the Board of Education (BOE) for the Kingston City School District (KCSD). We anticipate the two remaining agencies will hold public discussions and a vote sometime in September and October. Write and call your representatives and ask when the PILOT is scheduled to be on their agenda and to explain in advance (and in writing) the impacts of a tax-free deal for luxury housing will have on your school taxes.

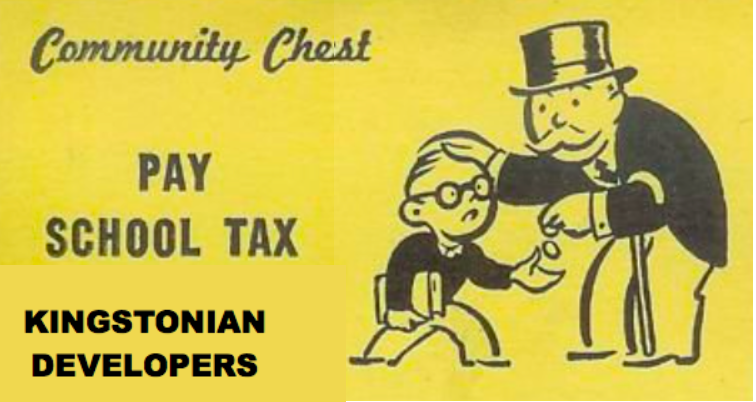

A wealthy developer will pay no school tax for 25 years?

What didn’t get a whole lot of traction during the Kingston council debate was the fact that the Kingstonian developer will pay nearly no school tax to the KCSD, and that impact will be felt by every municipality that pays into the school tax base.

In their PILOT application, the developers say that they anticipate minimal impact on the Kingston City School District because a similar project of theirs’ in Poughkeepsie has produced no school-aged residents. To further woo decision-makers, the developers are offering a $5,000 per year (for ten years) scholarship fund through the Community Foundation for the KCSD to use at their discretion. This translates into $50,000 over the course of 10 years in exchange for no school taxes for 25 years. Another pittance in comparison to their school tax without a PILOT is a $40,000 payment that will be apportioned to the city, county and school district. If 60% of the total tax burden – or approximately $24,000 a year – would be paid to the school district, all it would take is 1 1/2 new students to wipe that out.

What will it cost us?

So far, the developers characterize their financial information as “trade secrets” and have aggressively sought to shield that financial information from the public. Without this important information, the public does not know what portion of the $57,885,000 project is taxable and therefore, has no ability to calculate cost or potential benefits to taxpayers over 25 years.

Though at a recent special Kingston Common Council Finance and Audit Committee meeting, City of Kingston Assessor Dan Baker said that if the Kingstonian project were built today, the full property assessed value would be $19,000,000. Based on the 2019-2020 non-homestead tax rate, the school tax calculation of $30.10 per $1000, the school tax bill alone would be approximately $571,900 per year. Assuming the assessed value fluctuates and increases based on inflation and cost of living from year to year, the uncollected school taxes could end up being a staggering $18 million dollars over the life of the 25 year PILOT.

A tax-free deal for luxury apartments in Kingston will be felt beyond the Kingston city boundary. PILOTs result in less taxable value which requires everyone else to make up the difference. Municipalities that pay Kingston City School taxes include the Towns of Esopus, Hurley, Marbletown, New Paltz, Kingston, Rosendale, Saugerties, Ulster and Woodstock.